In World Economy News 23/02/2018

European Central Bank officials continued to lay the ground for a shift in policy language in the first half of the year after agreeing in January that it was still too early.

The euro rose then rapidly fell back as an account of the Governing Council’s Jan. 24-25 meeting published Thursday showed some policy makers were ready to remove a pledge to expand the bond-buying program if needed. That argument failed to win the day, with the ECB deciding such a change wasn’t yet warranted and that the wording should evolve gradually in line with progress on inflation.

The currency fluctuations showed how keyed up investors are for any nuance in ECB messaging. With the current round of bond buying due to end in seven months, policy makers at the Frankfurt-based institution are debating what their next step will be and how to communicate it.

What Our Economists Say:

“The minutes reflect the tension between the doves, focused on inflation, and the hawks, who prefer to emphasize the strength of the economy. A shift in favor of the hawks can’t be avoided indefinitely.”

–David Powell and Jamie Murray, Bloomberg Economics

Executive Board member Benoit Coeure said last week that officials are close to starting talks on altering their language.

“March won’t be a big bang in term of changes to forward guidance language — they will probably wait until the last possible moment with adjusting their communication,” said Nick Kounis, an economist at ABN Amro Bank in Amsterdam. “The ECB remains on a slow exit trajectory and it’s not going to win anything with early changes in guidance.”

Officials repeated a remark from their previous meeting that forward guidance could be revisited in the first few months of 2018, while framing this as “part of the regular reassessment at the forthcoming monetary-policy meetings.” Markets were rattled after an account from the ECB’s December session triggered expectations that changes to policy language were imminent.

The euro spiked higher initially after the publication of the latest accounts, before quickly reversing. It was up 0.4 percent at $1.2332 as of 3:41 p.m. Frankfurt time.

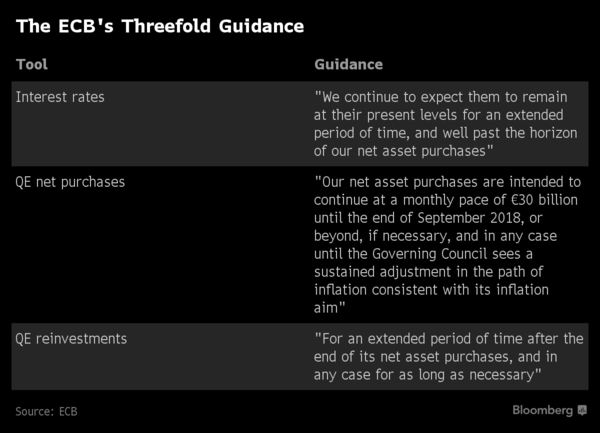

As strengthening global growth pushes more central banks to move away from crisis mode, the ECB’s decision surrounds what to do after September. At the January meeting, it confirmed it will keep buying bonds at a 30 billion-euro monthly pace until then, and that interest rates will remain low until well that.

While some policy makers want to start a series of small tweaks in their policy wording at the next meeting on March 8, others prefer to gather more evidence that inflation will pick up, people familiar with the matter have told Bloomberg.

The current guidance links the outlook for QE to progress on bringing inflation sustainably back toward 2 percent. In the future, policy makers could choose instead to emphasize the overall policy stance, which includes negative interest rates, if they wanted to start winding down bond purchases.

“Members widely acknowledged the need for steadiness in communication, which entailed re-emphasizing confidence in the inflation outlook,” according to the January account.

Source: Bloomberg